Disclosure: I received this product free through the Homeschool Review Crew.

When my children and I heard about an opportunity to review the PersonalFinanceLab Budgeting Game, Stock Market Game, and integrated curriculum from PersonalFinanceLab.com, we were excited.

The idea of a game and curriculum that encourages financial literacy was appealing and timely for us.

So, when we received our log-in information, I set aside some time to do my part on the admin portal. Then, I sat down 1:1 with my two older children, asked them if they wanted to try out the Budgeting Game or Stock Market Game first - or do both - and sat with them while they got going.

Both children chose the Budgeting Game, which was okay with me, because I thought it would be a solid way for them to reinforce money management skills.

In real life, both children have jobs now and have been learning to divide their income into spend, save, invest, and give categories, but they have not yet begun making budgets. So, I looked forward to seeing how the game helped them simulate the life a college student with real bills, such as rent, a car loan, utilities, groceries and some of the unexpected expenses and would challenge them to stay on budget while learning how to manage cash and credit cards.

I thought that once they got going, they'd be hooked and, then, we could roll out the real-time stock game, with live streaming portfolios, instant order execution, integrated research and reporting, etc. This would help, because both of my children want to begin investing in real stocks once they get a solid chunk of "invest" money saved.

Unfortunately, things did not play out that way here though, for, although PersonalFinanceLab.com offers a plethora of financial literacy learning lessons - with 50 personal Finance lessons and 20 Introduction to Stock Market lessons - integrated within the framework of its games, it just was not a good fit for my children.

That being said, before I detail my children's opinions, I want to say that the Budgeting Game and Stock Marketing Game do have merit and to encourage you to also click through the Homeschool Review Crew where you will find links to over 20 video, social media, and blog reviews, some of whom truly LOVED this product and can give you an enthusiastic recommendation for it.

I also want to commend PersonalFinanceLab.com on their customer service. Due strictly to user error (not the product itself), we had some log-in trouble and other issues and contacted the company. The reply we received was quick, helpful, and personalized to our issues and their correction. I was impressed by the prompt attention, and it made me appreciate this vendor.

Moving forward, I am hoping that as my eldest moves over to the Stock Market Game, the product will become more appealing to him. I hear from other Crew folks that it is fantastic, and from the little I have dabbled with it, it looks like it could really teach my children some new things.

When I interviewed my eldest child- 15 and a computer/independent learning lover - about this product, it went like this:

Moving forward, I am hoping that as my eldest moves over to the Stock Market Game, the product will become more appealing to him. I hear from other Crew folks that it is fantastic, and from the little I have dabbled with it, it looks like it could really teach my children some new things.

When I interviewed my eldest child- 15 and a computer/independent learning lover - about this product, it went like this:

What is Personal Finance Lab?

It is two online games. One is focused on stocks and the other is focused on a college student's life and personal finances. There are also articles and lessons.

Why did you want to try this game?

I was curious how it would work.

Can you tell me a little but about how the games work?

I have been focusing on just one game so far and have gotten a number of "months" into the game.

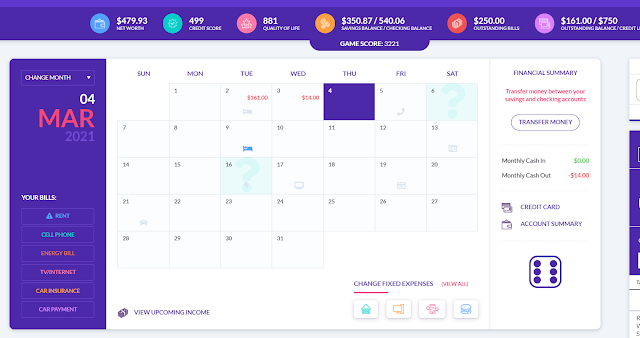

To play, you start off setting some things such as what type of groceries you want to eat, the size of your apartment, etc., which all affect your game play.

Then, you roll the electronic dice and the game starts going, moving you through days of the calendar.

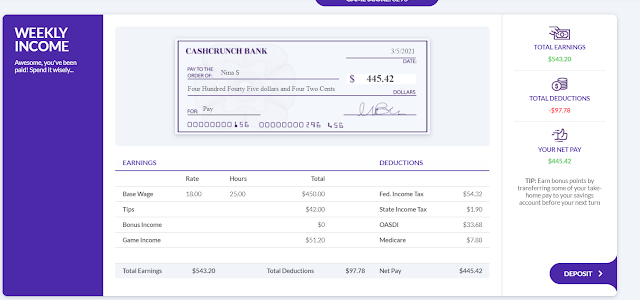

You get paid weekly and can increase your paycheck by working extra on Saturdays, which is simulated by doing a math game.

Some random events are thrown at you, some of which I like, such as the ones that let you choose things, and some of which I don't I don't like, such as when they just charge you, for example, $400, because you felt badly about dogs or something like that.

You also have bills to pay, such as rent, electric, gas, credit card, etc. - like life.

Periodically, they will ask you questions and, if you get them right, you get money. These questions are connected to lessons.

You also decide if you are paying credit or debit when you make purchases and can move money from savings to checking.

Have you learned anything playing the game?

Yes, I learned that in this game it appears that I will always make less than I owe or spend.

Other than that, I did not really learn much, because I have learned about finances before. I think someone who does not know much about finances can learn through this game.

Do you like this game? Do you think it is a good use of your time?

It's okay, but as a high school student who already knows much of what it's trying to teach, I should probably be spending my time doing other things.

I will try the Stock Market Game.

If you had to pick one thing you really like about it, what would it be?

It's a quick game. Each "day" of the game can be complete quickly and you can do a month in one sitting. It also seems like they are updating the game regularly.

Will you continue to use the program?

Yes, I want to try the stock game, because I do not know much about the stock market.

Until now, though, because of my other workload, I just wanted to focus on one game at a time. Now that I have given the Budgeting Game a chance, I will probably move to the stock game.

Would you recommend this product, and, if so, to whom?

For someone like me, I would not recommend the Budget Game. However, younger students and those who do not have much finance experience might appreciate it.

I am not sure about the Stock Market Game yet.

Is there anything that could be improved about the Budgeting Game?

I would recommend the game makers program it so you could have the ability to actually choose if you want to spend money as opposed to forcing you into doing so. Many of the incidents that come up are not things I would spend money on.

While I understand, the game is trying to show that there are random and unexpected expenses, it could improve how it does this. Expenses such as a car breaking down should be included in the game as a simulation of emergency expenses, but things like donations and other ways you could choose to spend your money in real life should be choices in the game.

My daughter 13, who does not always like online things, was oddly eager to try the Budgeting Game, and did sit and play for a full month of the game at times when she sat down with it, but did not relish all aspects of the game.

When I interviewed her, it went like this:

Why did you want to try Personal Finance Lab?

When we heard about Personal Finance Lab, I was excited. It sounded interesting to use to learn about financing.

What did you think about it?

I was disappointed when we got it, because I found it ...unrealistic.

The only fun part was the "work" game where you matched numbers, but that did not teach me anything. It just was more entertaining than the rest of the program.

What did the learning part look like?

In the part of the game when I was supposed to be learning, they had a calendar where you roll electronic dice and move spaces.

What did the learning part look like?

In the part of the game when I was supposed to be learning, they had a calendar where you roll electronic dice and move spaces.

Then, you get random things, like "You tore your bag on a nail, you can either buy a really expensive one or a cheap one. And if you buy the expensive one, the points of your quality of life will go up, because it probably won't break..." Then, a couple turns later, you get another scenario, sometimes quite similar.

Most of the scenarios did not fit my personality at all - such as "You went out and got coffee with friends," or "You bought tea at the grocery store," - and I would never do these things in real life, especially if I was behind with my bills. The game failed to give me an option to opt out of these choices.

Do you think there is a reason the game does this?

Of course. There are bills in life. Some you cannot opt out without penalty. The game demonstrates this, but with expenses like buying bags, coffee, make up, etc., you can opt out in real life, but the game would not let me.

Did the game teach or reinforce anything for you?

Would you recommend the Budget Game?

Not really. I was looking forward to having an enjoyable finance game that would teach me new things about financing. This one did not engage me.

What could make it better?

Perhaps it could be changed so that you could choose what you want to do - like whether you actually want to go get coffee with friends. There are some expenses - like bills and filling you gas tank so you can go to work - that are necessary. Other things should be optional.

Any final thoughts?

This game might be good for those who have no finance knowledge and who like online programs. It is not terrible. It is just not for me.

Learn More

Even though PersonalFinanceLab.com's Budgeting Game was obviously not the hit we hoped it would be here, I can see why it has proven to be a good fit for some families. It provides some solid, basic financial literacy learning, offers parents/teachers a full panel of options, gives students a chance to read basic lessons as an integrated part of the game, etc. There is also the Stock Market Game, which has real-time portions and, from what I have seen in dabbling with it so far, looks like a fantastic no-risk way for students to get a real look at how stocks work.

As I mentioned before, some other Homeschool Review Crew families absolutely LOVED the Budgeting Game and the Stock Market Game engaging and helpful and would HIGHLY recommend it. I encourage you to hop over to see some of their thoughts by clicking through the Homeschool Review Crew where you will find links to over 20 video, social media, and blog reviews.

PersonalFinanceLab.com offers a quality product that could use a few tweaks to be a better fit for my family but is already a wonderful fit for others. Perhaps it will be for you and yours!

Connect on social media: